Brandon Smith, CFA, CAIA, Portfolio Analyst at Boston Partners highlights the opportunity in Emerging Markets equities, allocator challenges, and a potential solution for a strategic allocation to the asset class. For questions or additional information, please contact us.

Emerging Markets: A Compelling Opportunity

Catalysts in Play: Few asset classes have enjoyed tailwinds as powerful or as enduring as those that characterize emerging market equities. The combination of higher productivity growth and higher working-age population growth should be familiar to global investors with long-term investment timelines.

Entry Points: However, it’s the disparity between the GDP growth in emerging markets – in which EM economies account for approximately 40% of global GDP – and the total market capitalization of EM equities, representing just 14% of the global stock market according to International Monetary Fund data, that should appeal to buy-and-hold investors. The catch is that the volatility inherent in developing economies can motivate behaviors that degrade long-term performance.

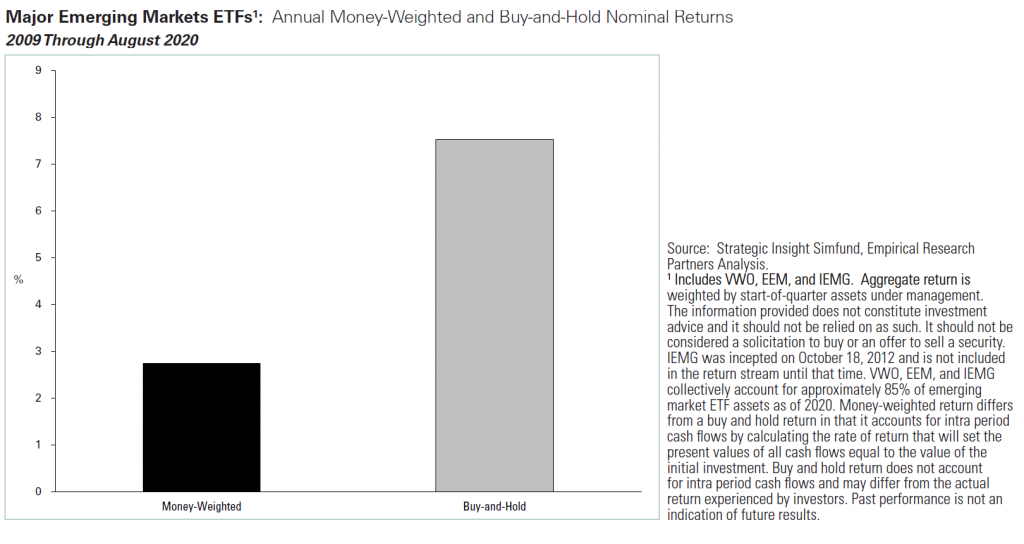

Strategic vs. Tactical Allocations: It’s not uncommon, for instance, for asset owners to view EM exposures as a tactical opportunity fueled by short-term developments. Data, however, underscores the challenges of trying to time the market, particularly to move in and out of developing markets.

Volatility vs Compounded Returns: Given the volatility, asset owners may be persistently under-allocated. And the volatility, on its own, can lower the compound annual returns for EM strategies over time.

Search for Solutions: We believe it makes sense for Emerging market equities to be a strategic holding in a diversified portfolio. The challenge confronting most investors is how to stay invested when there is high volatility in the asset class? Strategies that provide EM exposures with reduced volatility could be a potential solution. This would enable allocators the ability to remain invested in the asset class and avoid missing out on the potential return stream EM equities can provide.

Active Strategy: The Boston Partners Emerging Markets Dynamic Equity Strategy seeks to provide an EM like return over a full market cycle with reduced volatility. This is accomplished by taking long positions in stocks identified as being undervalued and high quality, and short positions in such stocks identified as overvalued and low quality.

For questions or additional information, please contact us.

Boston Partners Global Investors, Inc. (“Boston Partners”) is an investment adviser registered with the SEC under the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training. The views expressed in this commentary reflect those of the author as of the date of this commentary. Any such views are subject to change at any time based on market and other conditions and Boston Partners disclaims any responsibility to update such views. Past performance is not an indication of future results. Discussions of securities, market returns, and trends are not intended to be a forecast of future events or returns.